Analyst Fund

Our Fund:

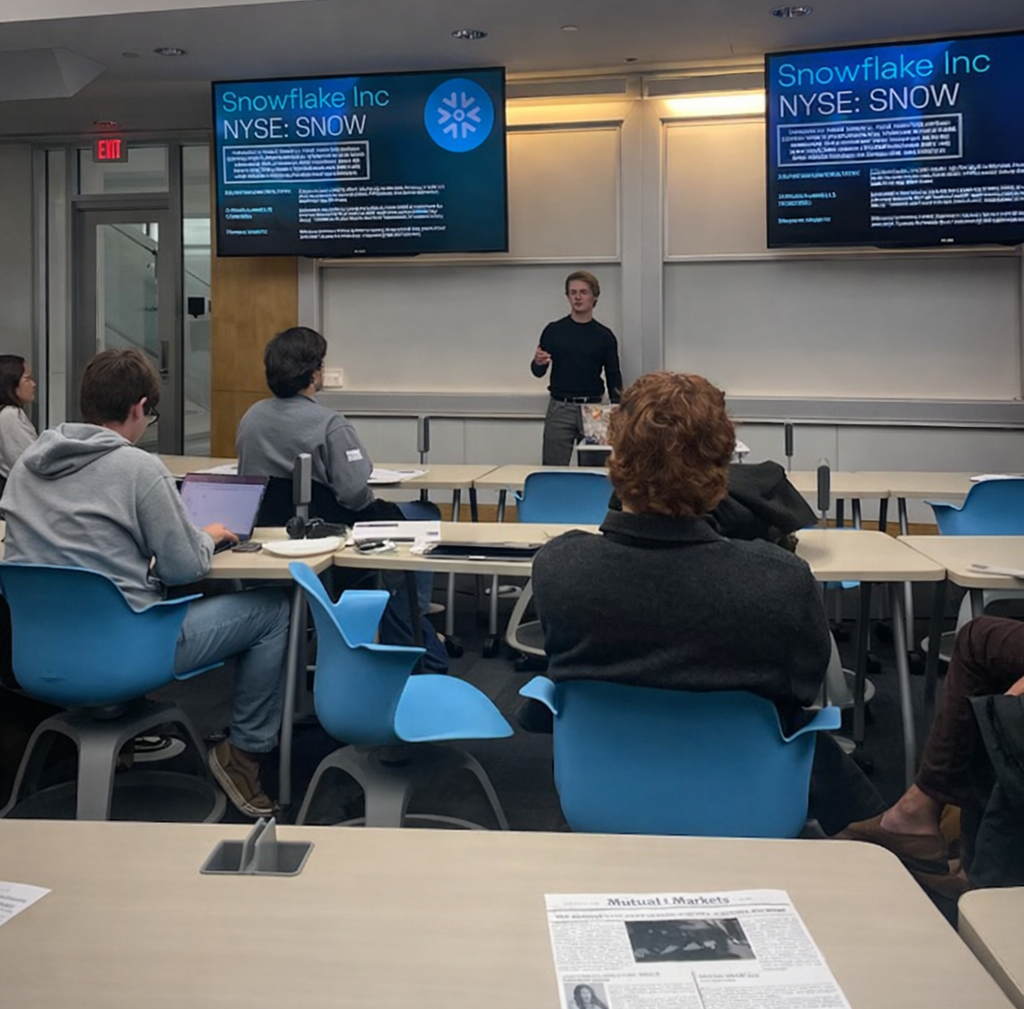

To provide real-world experience in trading and investment research, we manage a competitive Analyst Fund of ~$1.3K (as of Dec. 2025). Each week, analysts pitch new and exciting ideas and actively participate in the voting process during our Tuesday Fund meetings. When a pitch gains support, we move forward with the trade — giving members hands-on exposure to the fast-paced decision-making behind active portfolio management.

Performance:

Decisions:

Environment:

Both Junior and Senior Analysts have the opportunity to present investment pitches on investments of their choosing for our Fund. Following each presentation, fellow analysts provide their insights and opinions, culminating in a vote to determine whether the Fund will proceed with the proposed investment.

What We Trade:

Since inception, our entirely student-managed portfolio has generated approximately 25% cumulative alpha relative to the S&P 500, while increasing our capital by 14.25%, strengthening flexibility, and allowing for more trades in the coming semester.

The Analyst Fund is fast-paced, collaborative, and driven by curiosity. Analysts challenge each other with thoughtful questions, share diverse perspectives, and work together to strengthen every pitch brought to the table. It’s a place where ambitious students learn by doing — making decisions, taking ownership, and growing as investors in a supportive, high-energy setting with real consequences and real money.

We actively trade a diverse range of stocks, etfs, funds, and securities, including equities, forex, indices, metals, and cryptocurrencies. While the Fund has primarily focused on equities in the past, the introduction of a funded account enabled broader opportunities for diversification.

Fund Applications Open!

We are very excited to announce that for the Spring Semester 2026 our Analyst Fund applications are open, please complete the form to the left! Deadline for completion is 2/6/26 at midnight.

The application process consists of two rounds of interviews, each less than the last.